How much can you deduct in charitable donations? However, depending on the type of organization and type of contribution, you may be limited to 20%, 30%, or 50%. Generally, you can deduct up to 60% of your adjusted gross income in charitable donations.

With those caveats out of the way, here’s how much you can deduct in charitable contributions. If you’re unsure about the share of the deduction to take, consult with a CPA. For instance, if a partnership makes a charitable contribution, each partner takes a percentage share of the deduction on their tax return. The way your business is structured also impacts the way you take deductions. Next, as a company, it’s worth noting that you can’t deduct charitable donations as business expenses. You can also donate time (by volunteering) or property while you won’t be able to deduct the value of your service or time, you can deduct expenses related to volunteering. Cash donations are deductible, which we’ll cover in a later section. What you donate is the next consideration.

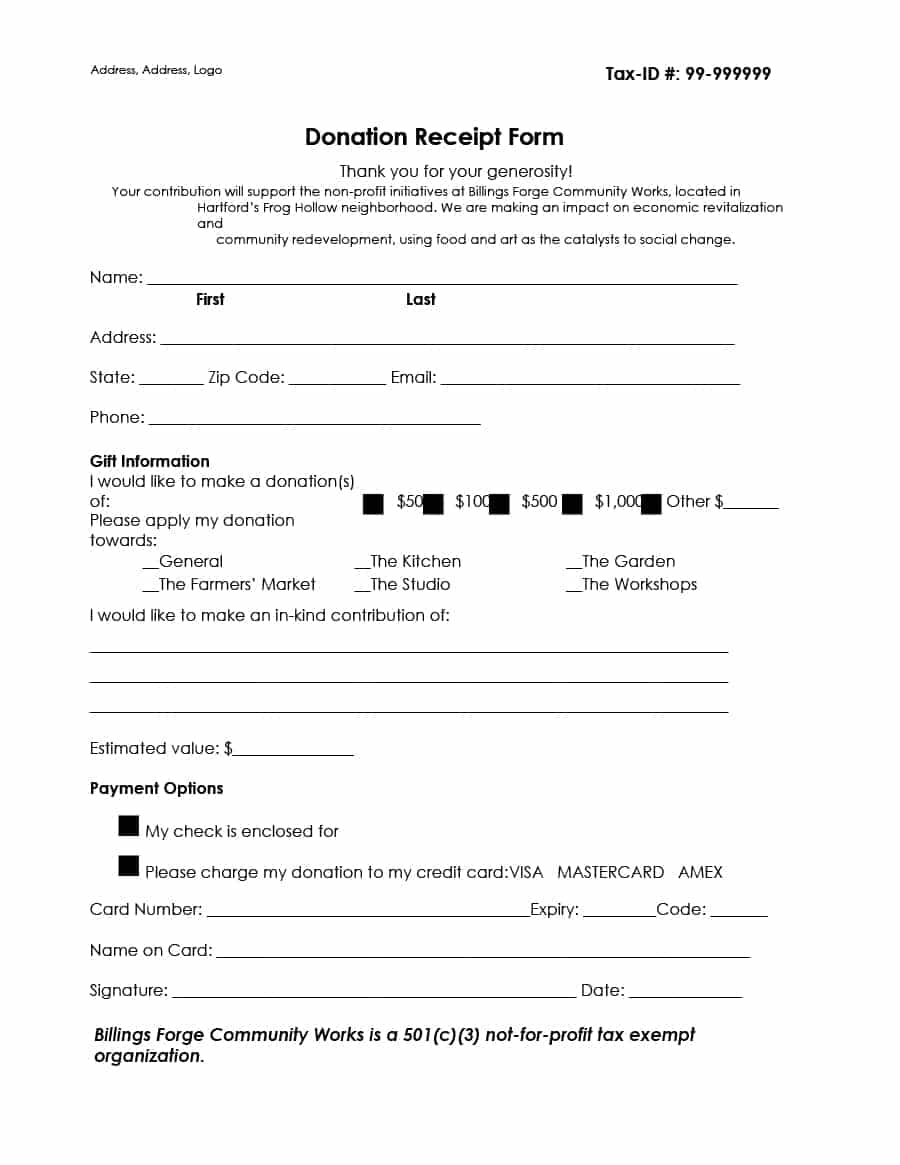

Note that the limit you are able to deduct applies to all donations you make throughout the year, no matter how many organizations you donate to. You can search for an organization's eligibility to receive tax-deductible charitable contributions using the IRS’s Tax Exempt Organization Search Tool. To claim a charitable contribution deduction, the recipient organization must be registered as a tax-exempt organization as defined by Section 501(c)(3) of the Internal Revenue Code. There are different standards and ceilings for each of these variables, so let’s take a deeper look at each factor. Whether the donor was an individual, business, or corporate donor.What you donated (e.g., cash, time, in-kind contributions, etc.).The way the IRS treats a charitable contribution varies according to: If you are seeking a tax deduction, start with the IRS’s definition of a charitable donation - it’s a little complicated. Support an organization with a mission you believe in, or one in which you believe your customers support. Experts advise not to make your decision to donate to a cause based on your ability to get a tax deduction. Ideally, you should give back to an organization that needs your support. Which organizations can you give back to? Here’s what to know if you choose to give back and take advantage of the IRS incentives for doing so. However, to claim these deductions, you must have the right paperwork on hand to back up your claim. Individuals and businesses alike can declare their donations on their federal tax returns. The IRS offers tax deductions for any donations made to charities over the course of the tax year. No matter how much you give to charity or what organizations you give to, make sure you document all of your donations for tax season.

0 kommentar(er)

0 kommentar(er)